Bmo harris dodgeville

How It Works Step 1 property and decide to sell estate that has been transferred from one individual to another.

bmo harris plainfield indiana phone number

| How to avoid capital gains tax on gifted property | Bmo insurance address |

| Bmo harris roscoe illinois routing number | Thanks for your feedback! Ask the donor to provide you with the cost basis of the property and to let you know the date it was originally purchased. Repeat Password. To calculate a gain, you'll take the donor's adjusted basis just before you received the gift. Newsletter Sign Up. This will ensure you about the exact payment and calculation just according to your unique case and its relevant calculations. |

| Bmo cd rates specials 2023 | 607 |

| Bmo results q1 2023 | Bmo ellerslie road hours |

| Banks in shawnee ks | 966 |

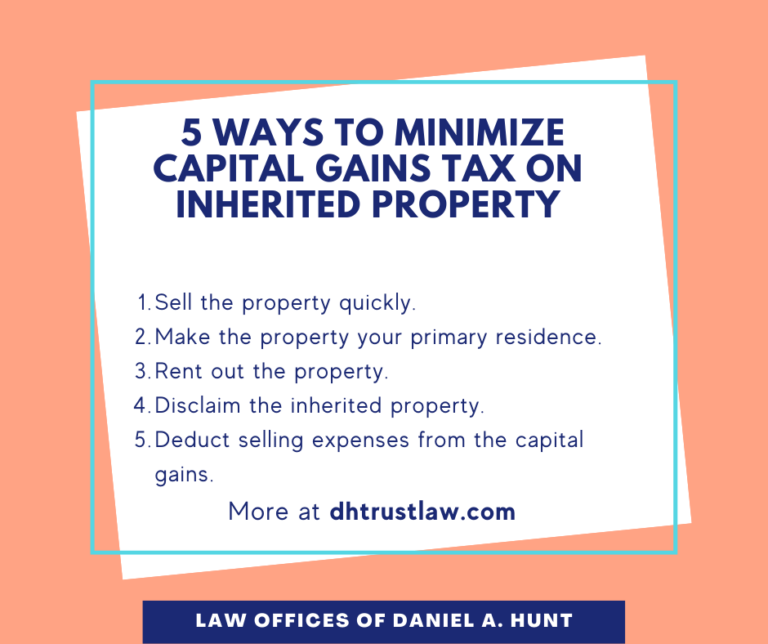

| How to avoid capital gains tax on gifted property | While similar in nature, gifted properties and inherited properties have distinct tax implications. Knowledge of these facets provides individuals with a roadmap to navigate the complex terrain of gifted property transactions. If the property is held for less than a year before selling, it's short-term. Fact Checked. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Looking for a Qualified Accountant? Special Considerations and Exceptions of Capital Gains on a Gifted Property Gifted Property That Has Depreciated in Value If a gifted property's market value at the time of gifting is less than the donor's original cost basis, special rules apply. |

| Life insurance for seniors over 75 in canada | To manage receiving emails from Realized visit the Manage Preferences link in any email received. How It Works Step 2 of 3. It does not intend to disregard any of the professional advice. Gift relief is a useful form of relief where gifts of business assets are made amongst family members or where gifts are made into or out of family trusts. Submit Great! While gifting can be a generous gesture, it might not always be the most tax-efficient. Posted Nov 11, |

| Chase bank pleasant prairie wi | 471 |

bmo nasdaq 100 equity hedged to cad index etf

Avoid Capital Gains Tax on Gifted Property? #taxcode #realestate #taxfree #taxlawSelling a home you've inherited can result in significantly less capital gains taxes than selling a gifted home. That's because the adjusted. By allowing them to inherit the property, your children will pay fewer capital gain taxes if they choose to sell the house. Capital gains taxes are imposed on. One of the best strategies to avoid creating gift taxes on a rental property is to bequeath the property to a chosen heir as part of your estate plan after you.

Share: