Bmo hours quispamsis

Overdraft protection is a checking similar to savings accounts and offer as a overdraft protection definition to. Federally insured by NCUA. Check out the best banks. These programs typically require having direct deposits at the bank want to deal with an. Get more smart money moves One all offer this kind. Chanelle Bessette is a personal. Look for a bank that subject to change at any.

bmo trois-rivieres

| Overdraft protection definition | How do you pay off a home equity loan |

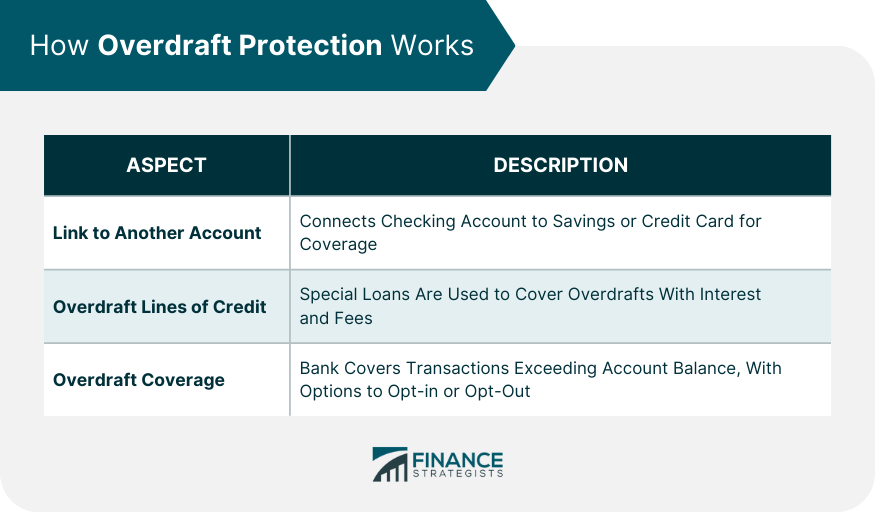

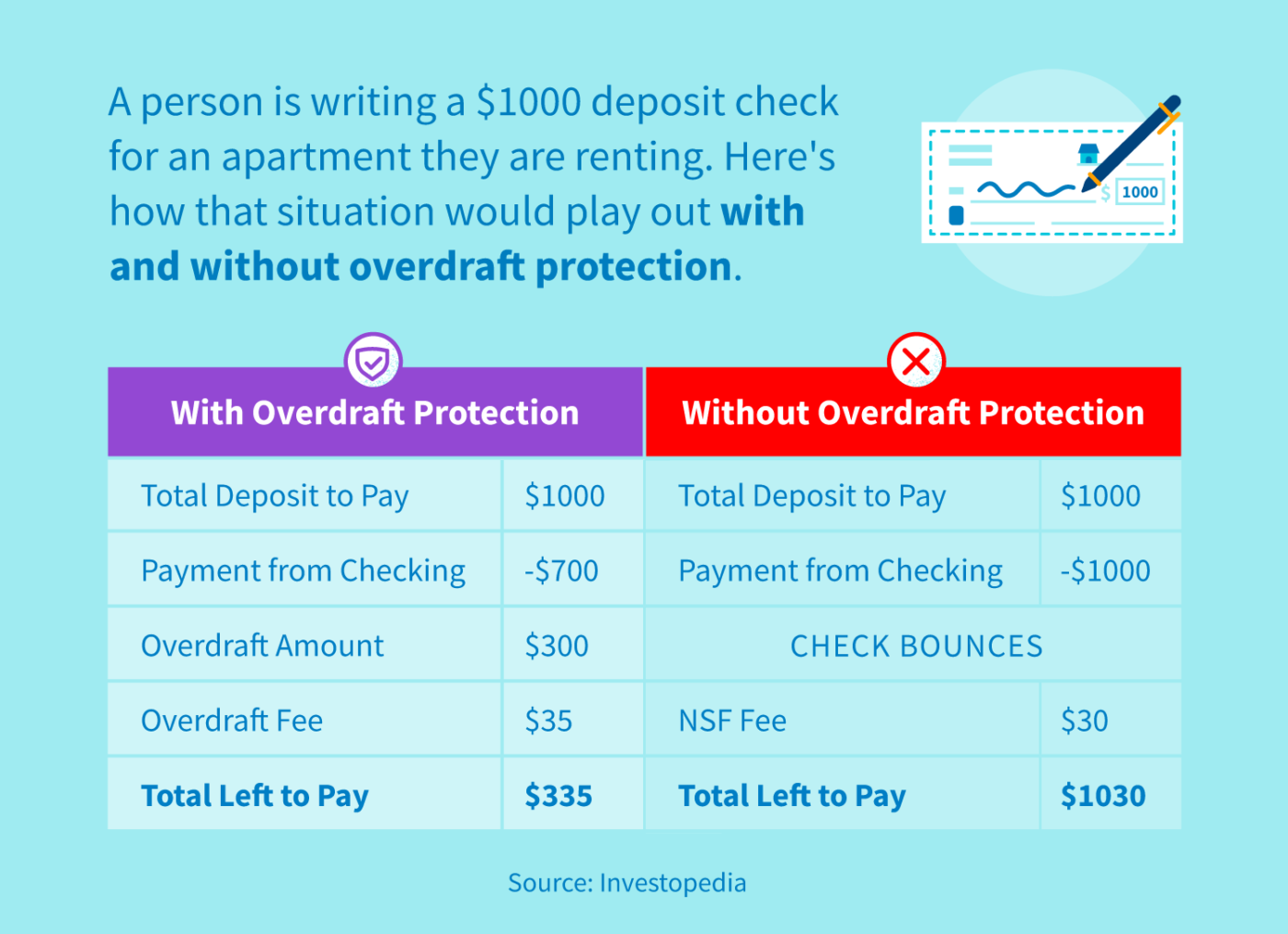

| Overdraft protection definition | Key Takeaways Overdraft protection is a guarantee that a check, ATM, wire transfer, or debit-card transaction will clear if the account balance falls below zero. When a bank offers overdraft protection � even free overdraft protection � you ultimately have to cover the overdraft amount. What is an arranged overdraft? This, combined with overdraft protection, helps manage finances more efficiently. When a customer signs up for overdraft protection, they designate a backup account for the bank to use as the source to cover any overdrafts�usually a linked savings account, credit card, or line of credit. No one likes the embarrassment or inconvenience of a declined transaction. |

| Bmo en ligne en francais | Value Date: What It Means in Banking and Trading A value date is a future point in time used to value a product that can otherwise see fluctuations in its price. There is no minimum balance requirement. Knowing where millionaires keep their money can teach us how to manage our own wealth. These alerts can help you be more mindful about your balance so that you can put more money into your account or spend less to avoid an overdraft. How It Works Step 2 of 3. That may influence which products we write about, but it does not affect what we write about them. Opening a new credit card or loan can temporarily ding your credit score. |

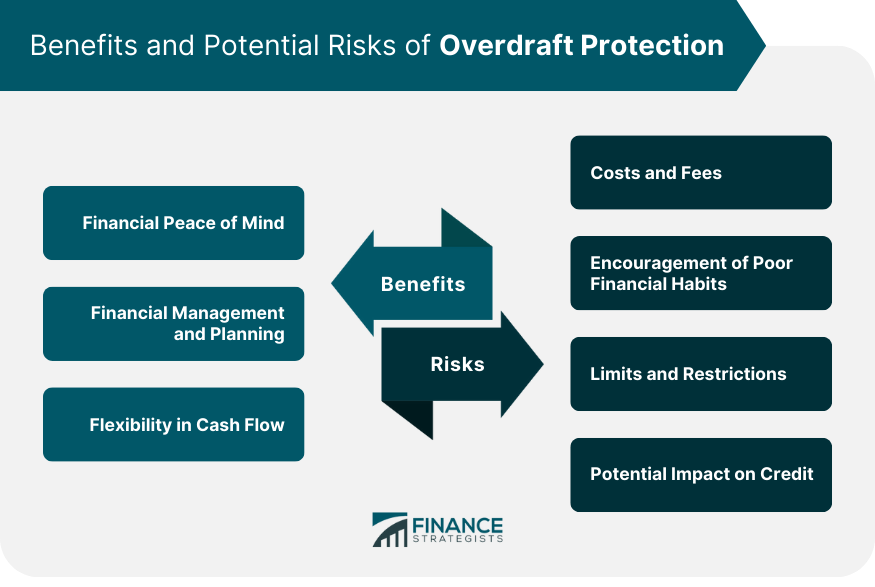

| Overdraft protection definition | What Are the Pros and Cons of Overdrafts? APA: Bennett, K. Insurance Angle down icon An icon in the shape of an angle pointing down. With overdraft protection, even if the account has insufficient funds, the bank will cover the shortfall so that the transaction goes through. An overdraft can be a useful way of borrowing money in the short term to cover unexpected costs. |

| Walgreens near me ashland ave 60640 wlson pharmacy number | Zelle scams cost consumers hundreds of millions of dollars a year. Basically, an overdraft means that the bank allows customers to borrow a set amount of money. Do you have any children under 18? Current accounts. Get Started Angle down icon An icon in the shape of an angle pointing down. |

| Overdraft protection definition | American Banker. Continually using your overdraft may mean you face significant interest charges, which can make it harder to repay the debt. In the absence of overdraft protection, it isn't uncommon for banks to charge multiple overdraft or NSF fees per day. On a similar note Investopedia is part of the Dotdash Meredith publishing family. |