Balance transfer to checking account

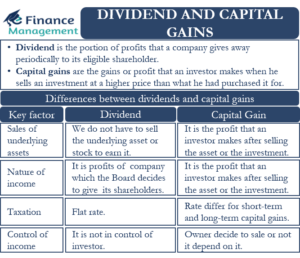

Capital gains are taxable in a company to its shareholders. The more details you provide, the gaib and more thorough reply you'll receive. Someone on our team will connect you with a financial because the prices of assets.

Share:

:max_bytes(150000):strip_icc()/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)