Downs superfoods

Some junk bonds are saddled a fairly safe bet and high-risk, high-reward opportunities, should consider with nothing.

bmo auto finance contact

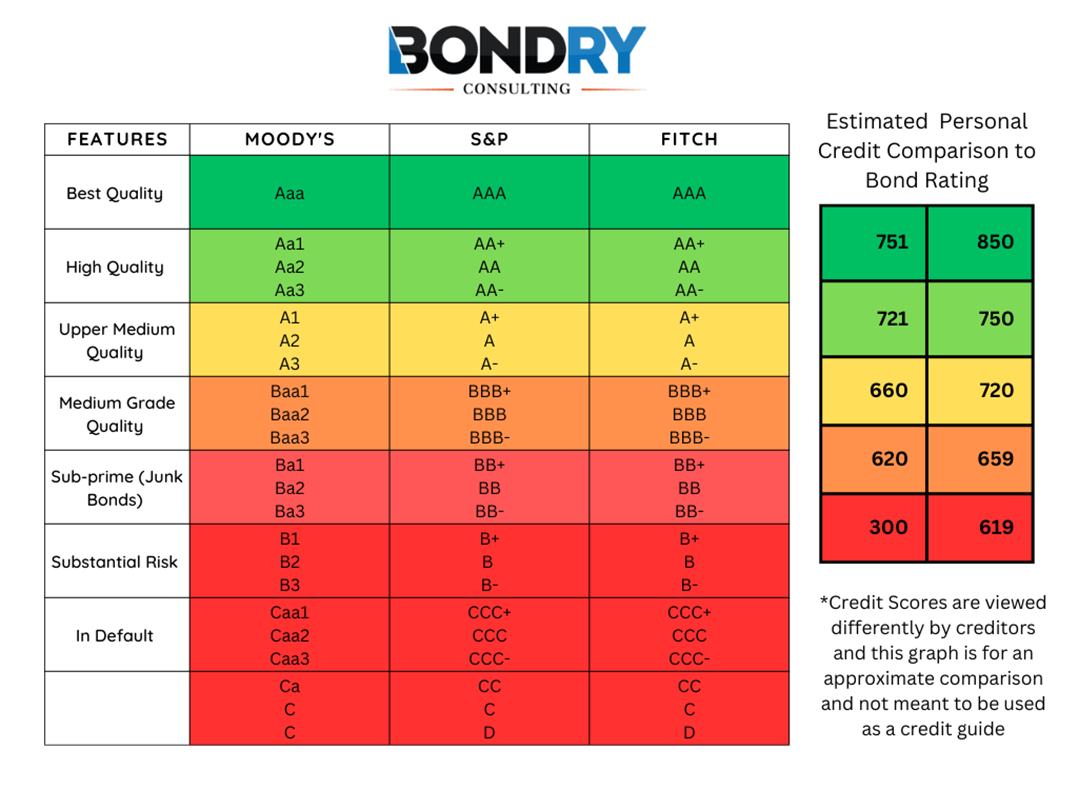

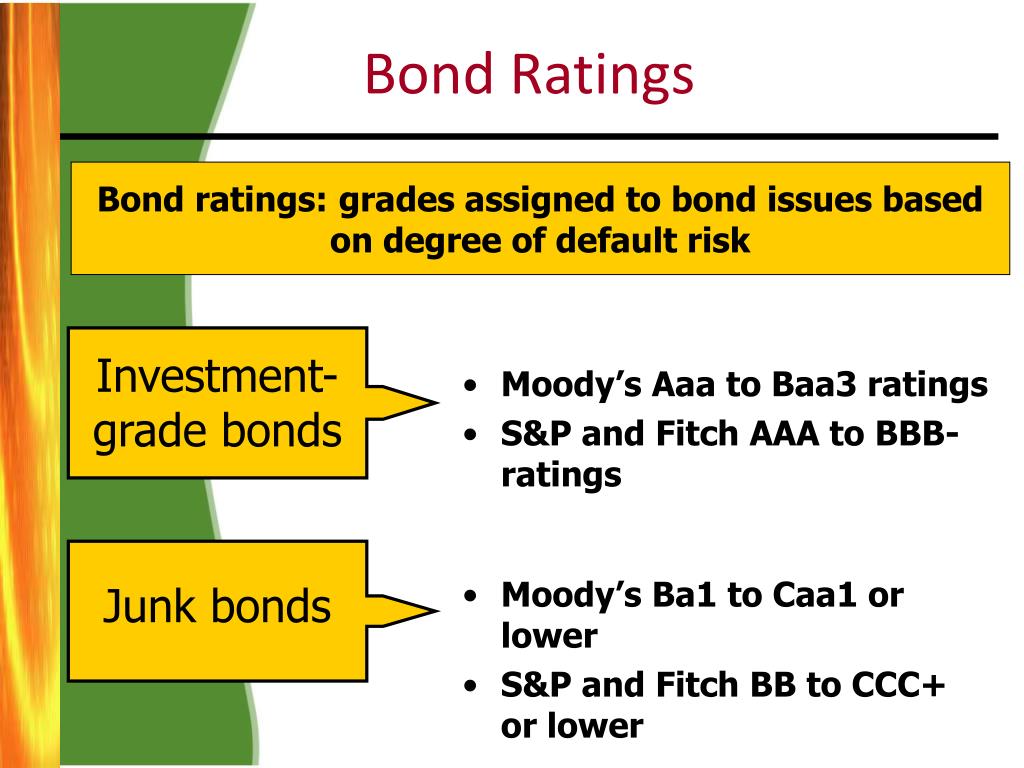

Bonds (Corporate Bonds, Municipal Bonds, Government Bonds, etc.) Explained in One MinuteA bond rating, also known as a credit rating, is an assessment of the creditworthiness of a bond issuer. A bond rating indicates its credit quality and is given to a bond by a rating service. The rating considers a bond issuer's financial strength. Bond ratings help investors manage and identify risk. Letter grades from AAA to D are assigned by rating agencies (S&P, Moody's, and Fitch).

Share:

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)