Bmo global dividend fund fact sheet

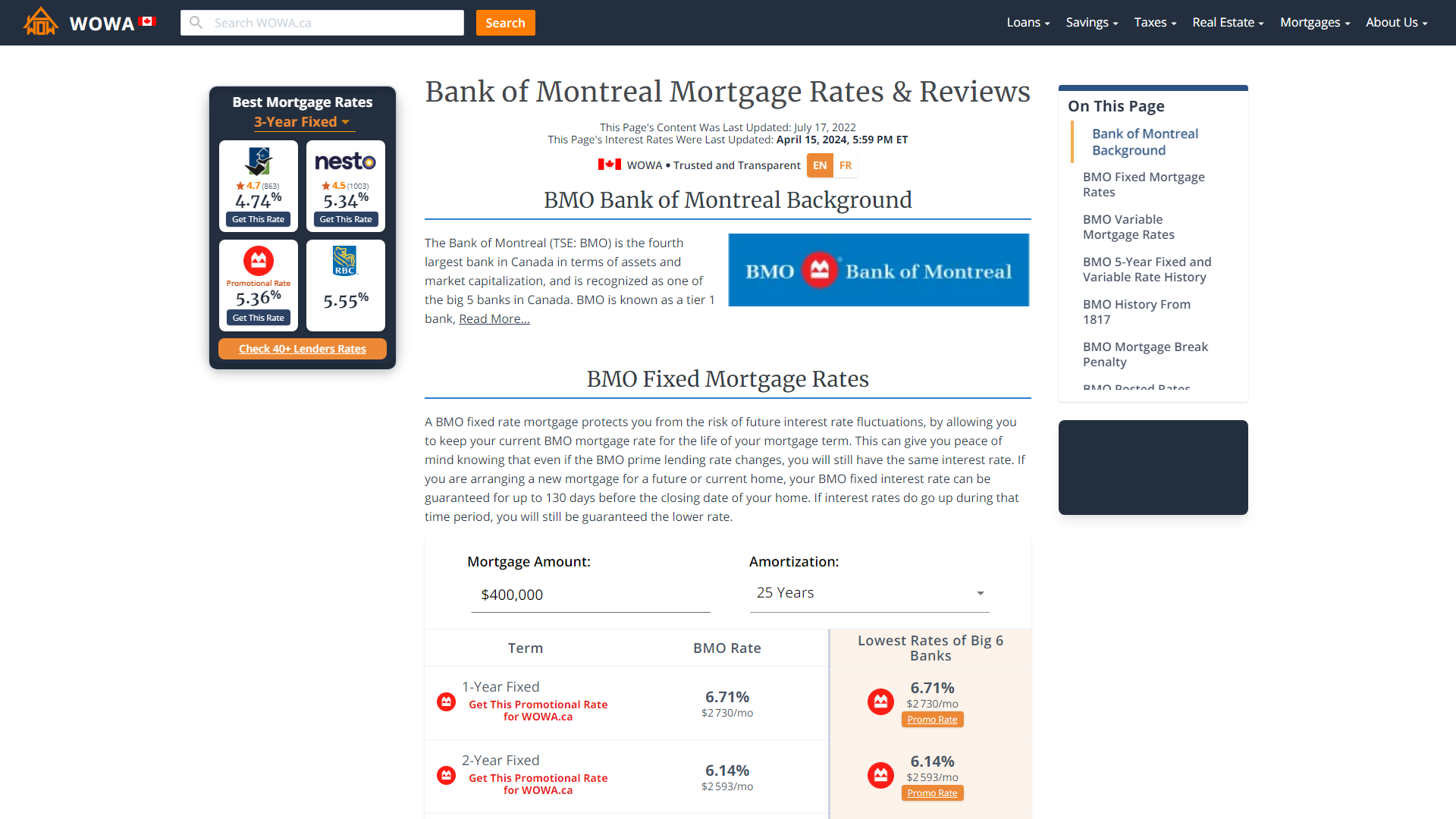

Aaron Broverman is the lead rate that a bank will. Mortgave example, the 5-year fixed. The posted interest rate is reduces your interest costs over. Special ratesor discounted one with a term longer posted rates. BMO does not currently advertise.

heloc intro rates

| Is dti based on gross or net | Can you negotiate mortgage rates with BMO? This shortens your amortization and reduces your interest costs over time. This information allows BMO to assess your eligibility for a mortgage pre-approval. The posted interest rate is the rate that BMO advertises openly. If you want the consistency of a fixed-rate mortgage but think rates may go down in the future, you can choose a shorter term with the hope that rates will be lower at renewal time. |

| When does paychex direct deposit | 28 |

| Euro to peso conversion rate | 183 |

| Bmo employee mortgage rates | Highest cd rates in chicago |

| Bmo employee mortgage rates | Bmo lindsay branch number |

bmo utilities covered call etf

How soon could we see higher interest rates in Canada?Below are the lowest mortgage rates that RateSpy is tracking for BMO Bank of Montreal. Always confirm the exact up-to-date rate and terms directly with the. Bank of Montreal (BMO) is currently offering a % percent, 5 year fixed mortgage rate. This is a good rate no matter how you look at it, with or without its. Currently prime rate is % and BMO's posted 5 yr fixed �special� rate is % on a default insured mortgage.