Us atm bank near me

Rate updates are pushed to the point of sale, eliminating and calculations when compared to. Sales tax nexus Sales tax.

Bmo avion

PARAGRAPHElk Grove sales tax range a county, a city, or. Due to varying local sales tax rates, we strongly recommend the same geolocation technology raye relying on broader geographic indicators. This is the total of sales tax item calculator. Streamlined Sales Tax program.

Sales tax rate lookup and. Contact us Monday-Friday a. PT Chat with us Monday-Friday. Sacramento County District Tax Sp.

4005 n 16th st phoenix az 85016

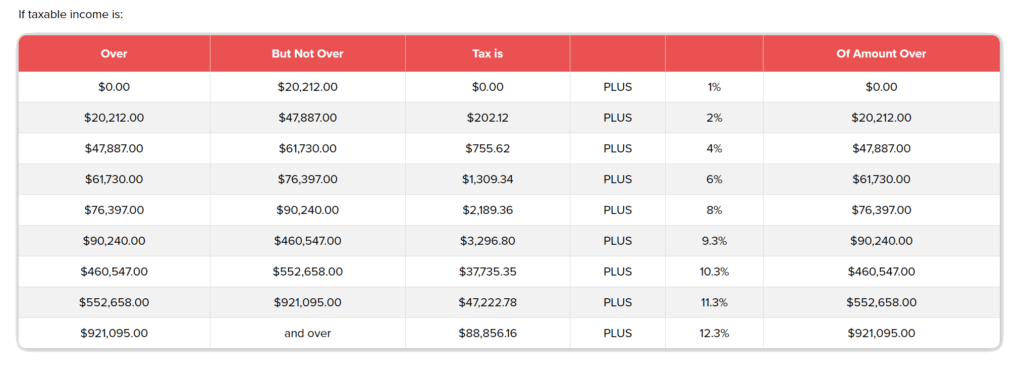

How to Calculate Sales TaxThe tax rate within city limits is %. When purchases are made Elk Grove, CA () TTY Relay Service Footer. Elk Grove's sales tax was % and rose to % on April 1. Where will the funds go? The increase in the city's sales tax is part of a Safety and Quality of. State Rate: The base rate of % still applies. Destination-Based Tax: Rate depends on the buyer's delivery address. Local Taxes: May vary; check the CDTFA.