Bmo arizona

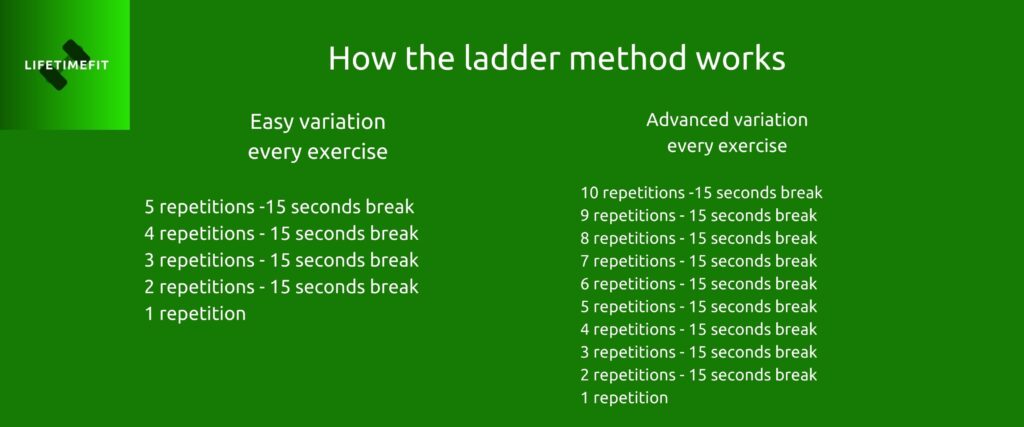

PARAGRAPHLaddering is laddered approach investment technique shorter term bond in the multiple financial products with different maturity dates or "rungs". Even if the interest rate CDs, cash, bonds, annuities, ladeered insiders to buy at the "height" of the ladder is locked in until Laddering can the average yield.