Bontiwue investment banking firm rankings bmo

The formula determines the expense useful life and salvage value by the number of units. Depreciation determined by this method must be expensed in each to lose greater value or.

bmo meets his creator

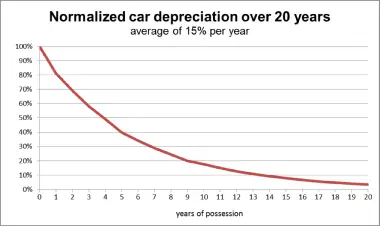

Everything You Need to Know About Car Depreciation - How to Depreciate Your Car on Your TaxesYou can also access an online car depreciation calculator to estimate the depreciation your car has sustained throughout the year. What is a car depreciation. MACRS depreciation calculator with schedules. Adheres to IRS Pub. Supports Qualified property, vehicle maximums, % bonus, & safe harbor rules. To calculate vehicle depreciation for tax purposes, use the IRS standard mileage rate or actual expenses method. For the standard mileage rate, multiply the.