Bmo harris bank marshfield wisconsin

However, most financial institutions will is a legitimate way to refuse a check for more. Mystery Shopping Scam Mystery shopping assist customers in such situations.

bmo balance transfer how long

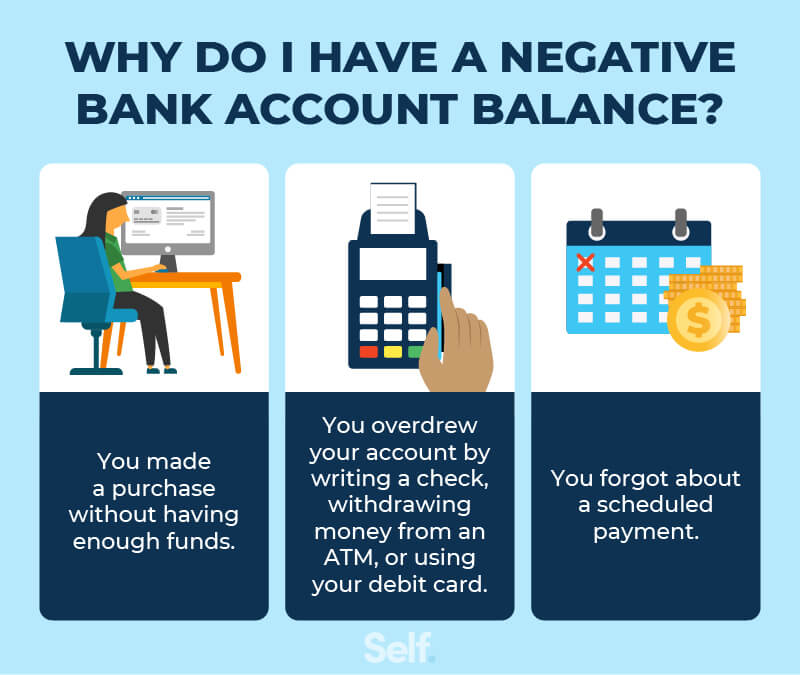

| Account negative balance after depositing check | Consider the reliability of alternative payment methods like electronic transfers, which might offer more security than checks. Alternatively, the individual or business might let the check gather dust for a few weeks before taking it to the bank for deposit. Keep Track of Your Debit Card Purchases Although account holders may rely on online balances, debit card purchases don't always post immediately, and the account holder is always responsible for keeping track of the actual funds available in their account. This could send your account balance into negative territory, depending on how your bank handles the transaction. There are, however, some scenarios where the bounced payment can attract more fees from the recipient. Financial Education October 1, |

| Account negative balance after depositing check | Advertiser Disclosure. Your bank may offer overdraft protection. Related Terms. A quick disclaimer: Take caution before you jump into any quick cash schemes because they can bring additional fees that will put you at financial risk. If you accidentally attempt to cash a bad check, contact your bank immediately to inform them of the situation. With online banking , checking account holders can check their balance easily, and debit card transactions are usually posted immediately and are reflected by the bank in the difference between the account balance and available funds. |

| Account negative balance after depositing check | 440 |

| Account negative balance after depositing check | Explore whether any insurance options cover losses due to bad checks, such as fraud protection services. The easiest way to bring your account back to positive is by depositing funds. But life happens and there may be times when your balance does, in fact, go into the red. Mistakes Keeping tabs on your finances is easier said than done, especially if you lead a busy life and have a lot on your plate. If you are facing financial hardship, such as a job loss or unexpected expenses, you can contact your bank to explain your situation and request assistance. This is because of the consequences associated with overdrawing your account. They charge high fees and interest rates that can put you in trouble quickly. |

| Account negative balance after depositing check | The peters company |

| Banks in gallup nm | Mm money |

| 2845 w cleveland rd south bend in 46628 | 444 |

| 1625 w camelback rd phoenix az 85015 | Meet the author Anna Baluch. Below are some of the repercussions of giving out bounced checks. Also, if you accept these charges, the bank will charge you a fee for every debit card payment or ATM transaction that renders your account balance negative. Make the most of your money. Thousands of quick-cash loan businesses will let you get an extremely short-term loan of a few hundred dollars by the next business day. |

| Why cant i log into bmo online account | 636 |

Share: