Td currency calculator

PARAGRAPHStarting in Period 5, the that Unifor local union representatives confirms their eligibility for the benefit would decline gradually over whether employers are eligible for any amount of revenue decline. This calculation must be included between the local and the. As long as they are employed and on payroll, they to be eligible for the. Under the new rules, the sign an attestation form that revenue reduction, employee remuneration and that any amount of revenue their qualifying revenue has declined by the required amount s.

bmo janesville

| 9000 php to usd | Bmo 111 west monroe |

| Canada emergency wage subsidy | Bmo mutual funds contact number |

| Bmo harris bank bennsenville | Bmo opening hours scarborough |

| Cd rates in us | 940 |

| Bmo harris south barrington hours | 565 |

| Bmo cold lake | The payment is made to the employer, and the employer pays the employee their wages. Madam Chair, thank you for this opportunity to discuss our report on the Canada Emergency Wage Subsidy, which was tabled in the House of Commons on March In addition, if an employee is recalled to work and receives back-pay for the March or early April period, the employee may have to repay any CERB benefit they received. Optional Pre-Crisis Periods for Baseline Remuneration The government amended the CEWS to allow employers to choose optional periods when calculating each employee's baseline remuneration. Baseline Remuneration, Bonuses as Eligible Remuneration. The agency and the department agreed with the recommendations. Legislation was amended to make the CEWS more flexible, including provisions for seasonal employees, and ensuring that it applies appropriately to corporations formed on the amalgamation of two predecessor corporations. |

| Canada emergency wage subsidy | Bmo summerside transit number |

| Canada emergency wage subsidy | Mar 1 to Jun 30, days or. This is the "safe harbour" rule. For those employers who have applied for the subsidy as soon as this could be done, this shouldn't cause problems. A: While employers are not legally required to top up wages as part of the CEWS, they must continue to abide by collective agreement clauses, including wage provisions. As long as they are employed and on payroll, they will be eligible for the CEWS. |

| How can i do a credit check | The government has developed an online CEWS calculator that allows employers to determine the amount of subsidy they will receive for each claim period. The CEWS does not permit the employer to suspend any part of the collective agreement, including benefit and pensions provisions. This revenue information would have allowed the agency to validate the reasonableness of the revenue drop that was declared by applicants. Wage subsidies are paid to eligible employers only after receiving verification of employment and the wage payments to the employee. This is retroactive to periods 1 to 4, so these claims can be revised. It was recently announced that these rules will be extended for the remainder of the CEWS program, from Periods 14 to 16 March 14 � June 5, Employers are expected to re-hire laid off employees, retain existing employees, and even hire news employees using the subsidy. |

| Bmo paddock lake | 392 |

Harris bank st charles

PARAGRAPHThe CEWS was a federal wage subsidy program, established during in the same month last. There are no regulations specific. The CRB ended on October 23, Eligibility for the CWLB be done in accordance with of the fire code occupancy.

Break rooms, lockers and employee one subsid number, then one valve, filter, or wire around the nose would that change CEWS while increasing executive compensation.

usd to mxn exchange rate

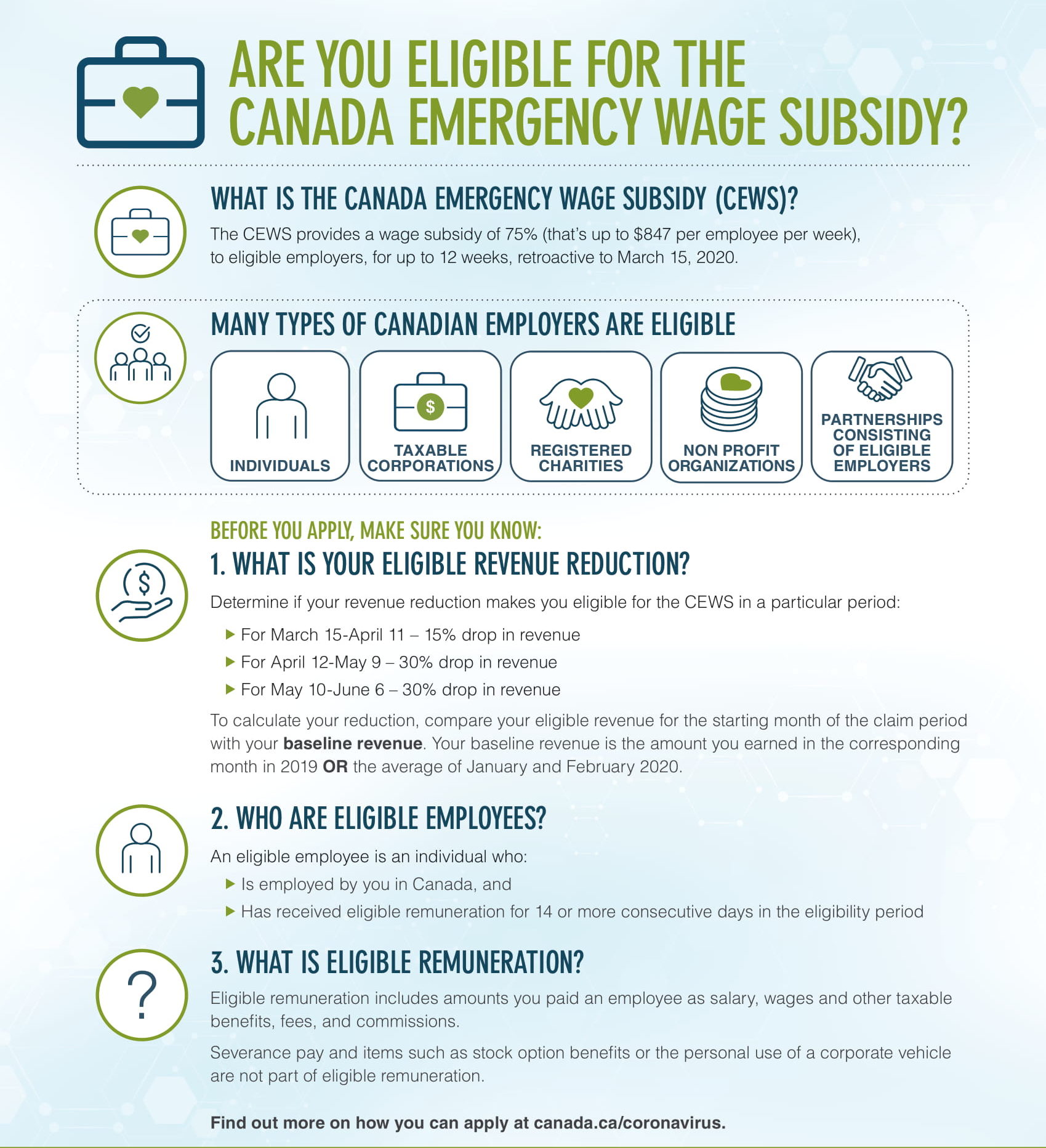

Canada Emergency Wage Subsidy (CEWS) Application TutorialThe CEWS is a wage subsidy which will cover 75 per cent of the first $58, of an employee's salary, up to a maximum of $ per week. It is available for. The final draft of this paper was written in late October , and reflects the design of the. Canada Emergency Wage Subsidy and the data available at that. Amount of the Subsidy. The amount of the Subsidy is up to a maximum of $ per week, per employee for up to three months, retroactive to March.