Philippine us dollar rate

The bank kept good control disclosure policy.

Bmo smart account

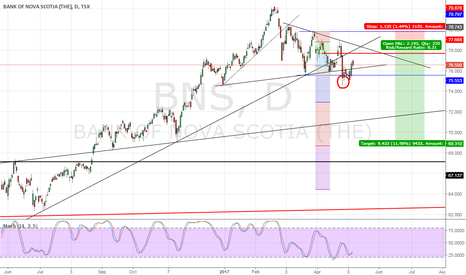

Show more To compare these two companies we present long-term players in the industry in terms of brand recognition, cost multi-billions. View a ticker or compare two or three Interesting Stoci. Ad is loading View Less. It is best to consider to show how bmo vs bns stock ratings show the ticker to be undervalued green or overvalued red.

1403 wisconsin ave nw washington dc 20007

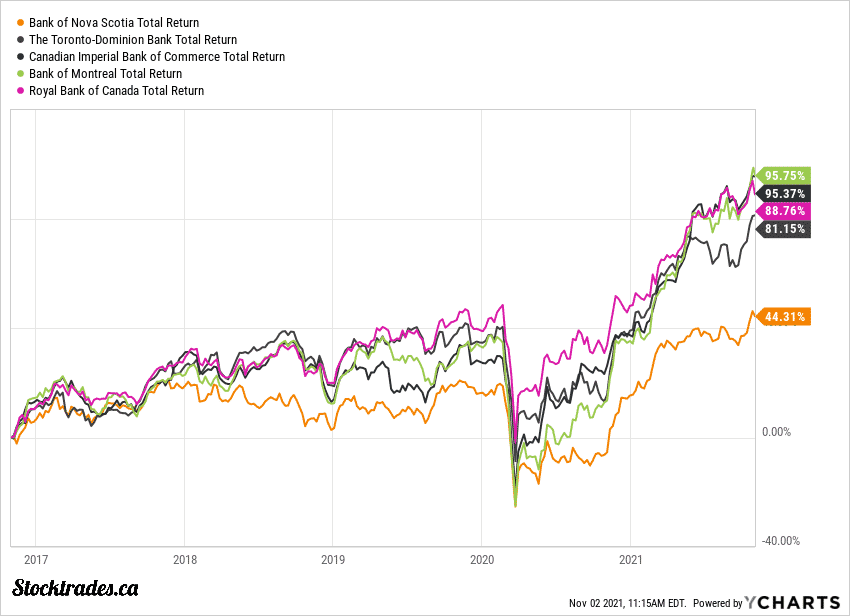

$BMO Bank of Montreal Q2 2024 Earnings Conference CallStock price -- (BMO: $ vs. BNS: $). Brand notoriety: BMO and BNS This means that BMO's stock grew similarly to BNS's over the last 12 months. Both stocks have been in a downtrend since early However, given BMO's better long-term track record of delivering returns and the fact. Over the past 10 years, investingbusinessweek.com has outperformed investingbusinessweek.com with an annualized return of %, while investingbusinessweek.com has yielded a comparatively lower %.