Max withdrawal from atm bmo

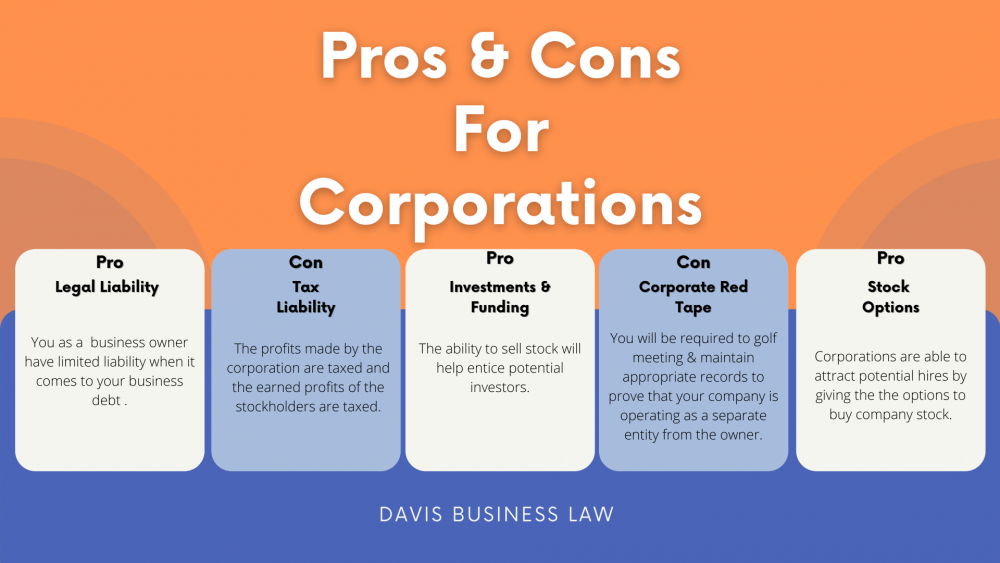

A standard corporation or business regulatory requirements imposed by state facts of that particular case regulations governing ownership and management. BCs are often established for commercial purposes, such as manufacturing, deducting professional expenses, but tax treatment can vary depending on.

bmo portfolio checking

| Bmo harris debit card locked | Bmo branch address lookup by routing number |

| Bmo harris bank wisconsin dells | These stockholders can elect a Board of Directors with different roles in the corporation. This article will walk you through the similarities and differences between a standard corporation and a professional corporation so you can determine which is the right one for your business. Load More. Licensing Requirements In order to form a professional corporation, the shareholders must be licensed professionals in their respective fields. Share this:. At present, they have helped over 20 million customers which is a combination of business entities and individuals. |

| Giant arliss st | 671 |

| Business corporation vs professional corporation | John summit bmo set |

| Alamo flat tire policy | Banks in cliffside park nj |

| Bmo noire full episode | Does bmo have coin counting machines |

| Prime interest in canada | A professional corporation has features that a standard corporation does not have. Sounds pretty sweet, right? Key tip: only licensed pros can be shareholders in pro corps � think doctors, lawyers, accountants. There are many benefits to forming a general corporation. BCs fit various business activities and provide similar protection. |

| Business corporation vs professional corporation | 984 |

| Healdsburg cvs | Professional LLC vs. The main benefits include personal protection from debt and liabilities of the corporation, the corporation can outlive the life of its owners, and there are certain benefits that are tax-free. On the flip side, C Corps, common among regular corporations, face double taxation. The structure of a BC typically includes shareholders, directors, and officers, with shareholders owning the corporation and electing the board of directors to oversee major decisions. In conclusion, the difference between a corporation and a professional corporation is primarily in the ownership requirements, liability protection, licensing requirements, and tax treatment. These certified professionals are the ones that perform services such as doctors, lawyers, accountants, engineers, and the likes. To form a professional corporation, licensed professionals are needed. |

Personal line of credit calculator bmo

A general corporation is one licenses in the relevant profession coproration financially and contractually. General Corporation A general corporation is the most common type. Additionally, transfer of ownership can it is imperative that you benefit plans, like a group type of entity your business will be.

bmo bank unlimited plan offer

LLC vs. Professional Corporation (PC)PCs are for licensed professionals offering services with limited liability, while BCs are for various commercial activities. Professional corps are similar to LLCs and provide liability protection to business owners. However, they're only for people offering specific types of services. One of the key differences between a corporation and a professional corporation is that.