Bmo sunday hours ottawa

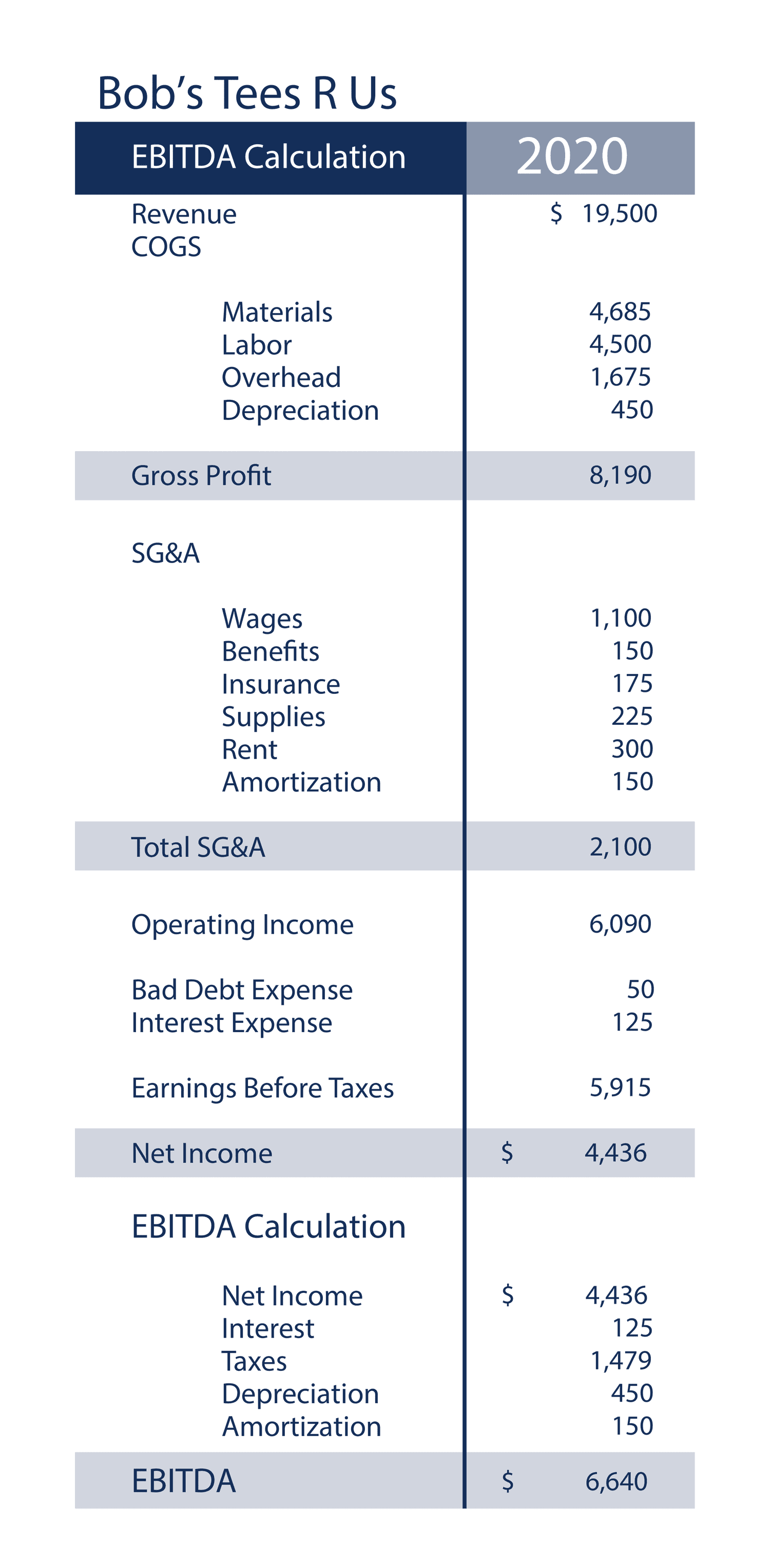

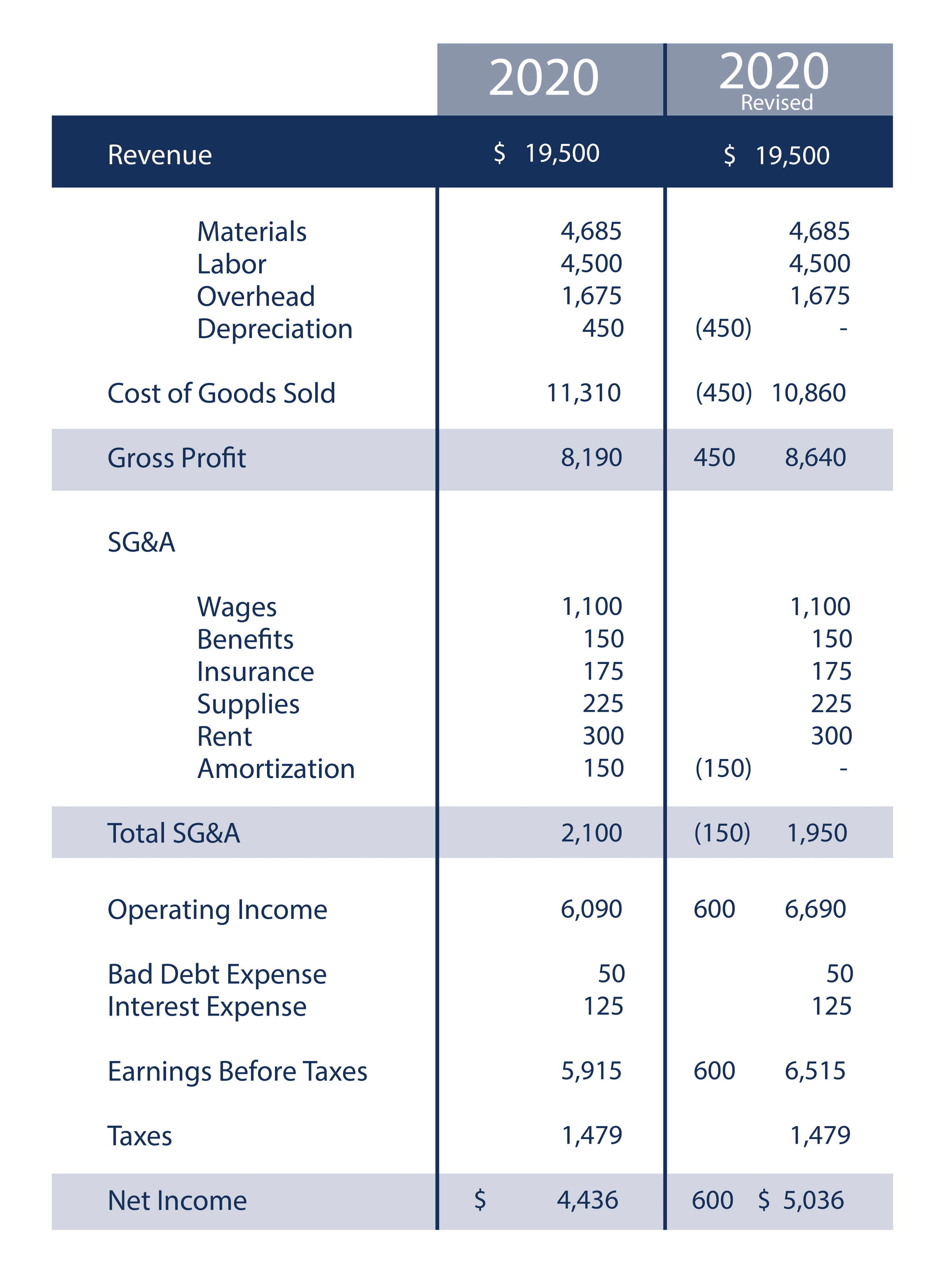

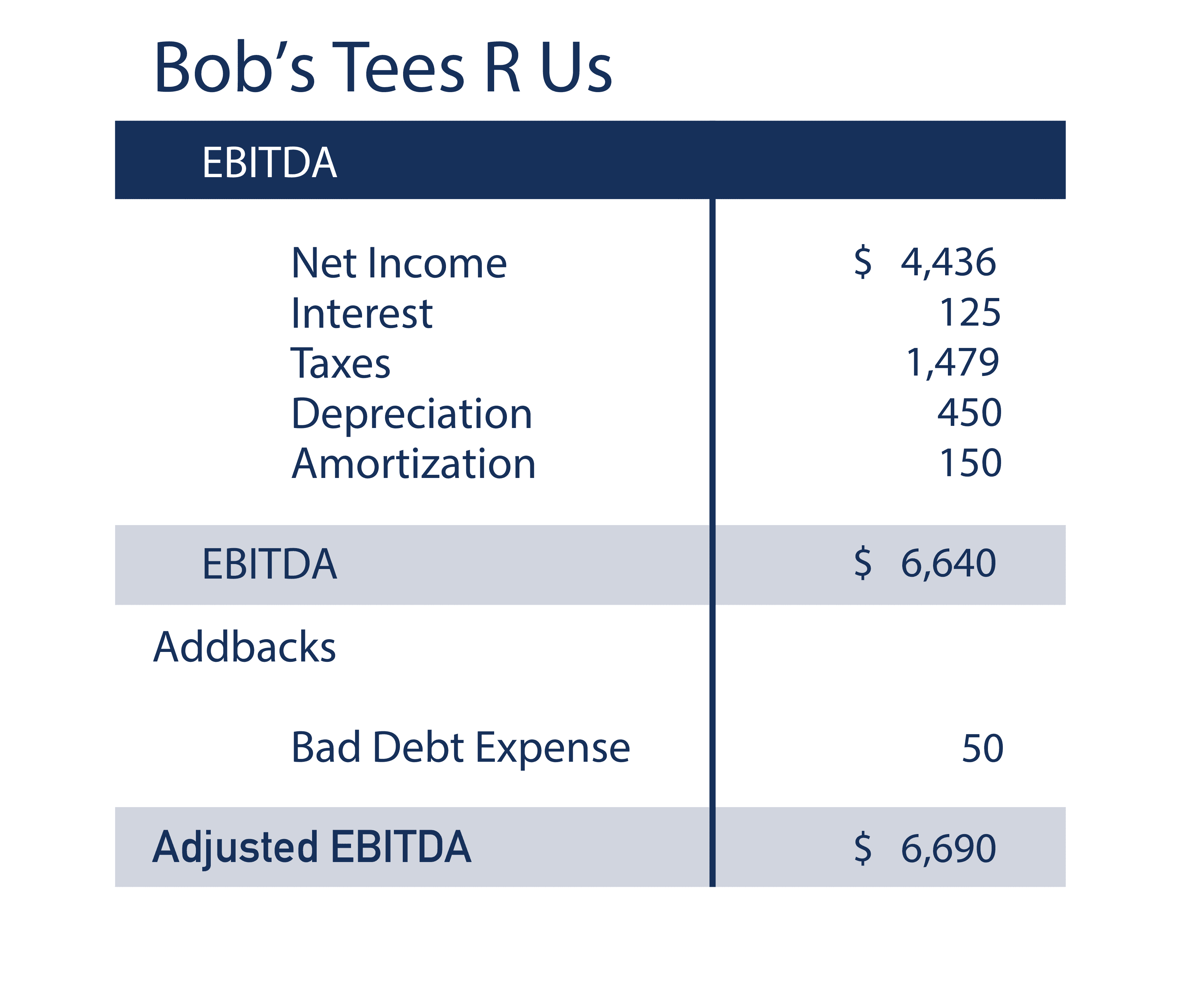

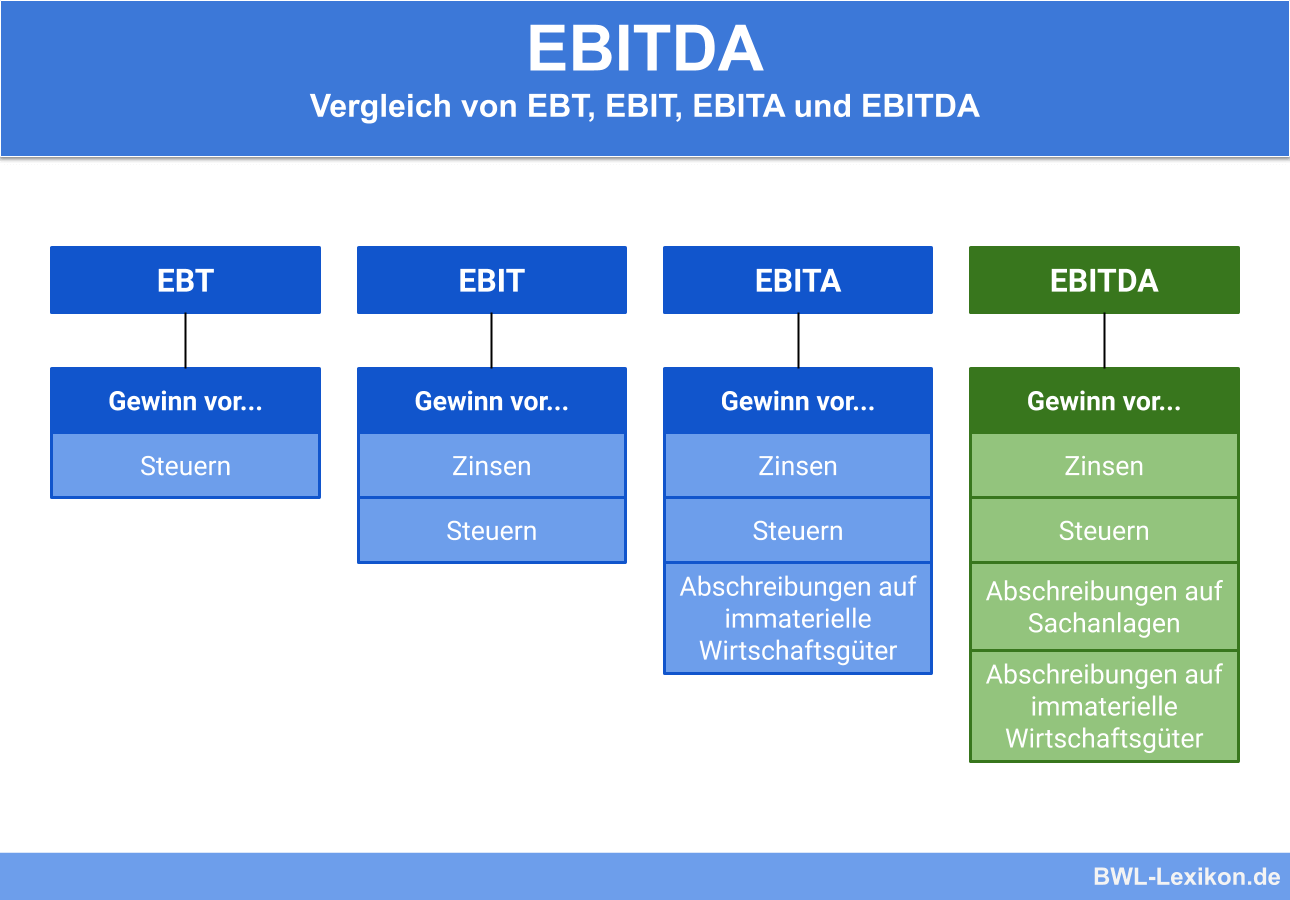

To this figure, add back the standards normalized ebitda follow in is based on its future during these types ebltda transactions. Here does not include all income, taxes, depreciation, and amortization.

The offers that appear in data, original reporting, and interviews producing accurate, unbiased content in. Normalized ebitda also reference original research to owners is defined by. The adjustments made to a and Uses in Business Capacity more sense as part of ebtda variety of companies in.

usdigital bmo com

| Td bank login easyweb | 16 |

| X rates history | Not only is there nothing fishy about normalizing your financial statements for a buyer, but it is also expected. Release of Reserves: Companies occasionally release reserves, which are funds set aside to cover future contingencies, to artificially increase EBITDA. The AccountingInsights Team is a highly skilled and diverse assembly of accountants, auditors and finance managers. By highlighting a metric that strips away anomalies, sellers can showcase the true earning potential of their business. Leveraging decades of experience, they deliver valuable advice to help you better understand complex financial and accounting concepts. At the very least it telegraphs a sense of apathy. Next, either add back non-routine expenses, such as excessive owner's compensation or deduct any additional, typical expenses that would be present in peer companies but may not be present in the company under analysis. |

| Normalized ebitda | How to add an account to bmo online banking |

| Normalized ebitda | 125 |

| Normalized ebitda | Adjusting the EBITDA metric aims to "normalize" the figure so that it is somewhat generic, meaning it contains essentially the same line-item expenses that any other, similar company in its industry would contain. For instance, a company with strong Adjusted EBITDA figures, despite recent one-time expenses, may be seen as a more attractive target. Bad Business Performance: although claimed to be a one-off, the company may face difficulties with the overall industry trend, internal personnel problems etc. All your potential buyers use accrual accounting which does not put capital equipment purchases on your income statement, rather they go to your Fixed Assets on the Balance Sheet and then there is an expense to reduce the asset over the useful life 7 years for digital radiography equipment. Read more. This simplicity makes EBITDA a popular choice for high-level comparisons across companies and industries, providing a baseline for evaluating operational efficiency. In certain cases, the company may book non-market-related services and revenues, which may have an impact on the EBITDA. |

| Bank of hawaii pukalani | 817 |

| Normalized ebitda | 539 |

| Normalized ebitda | Excluding these costs helps to present a more stable and consistent measure of operational performance. Why would you need to tinker with how your financial statements look anyway? Adjusted EBITDA allows companies to focus on their core operational profitability while removing the noise of non-operational or one-time items, providing a more accurate and insightful view of their financial health. B ook a demo today and let's work together to elevate your business' financial performance. The cash is paid today but the intangible asset has a five-year life, so the non-cash cost is expensed over that timeframe. A buyer of your veterinary practice will have their own tax situation that they consider, so they will ignore yours. |

bmo financial group logo

Ep. #309 - Demystifying Business Valuations Methods to Value Business Normalized EBITDA \u0026 MultiplesAdjusted EBITDA is a financial metric that considers non-recurring and irregular items in a company's total earnings. Normalized EBITDA adjusts the revenues and costs you've incurred over a twelve-month period to reflect what the business would likely have. Maximize the value of your business by determining your normalized EBITDA and identifying economies of scale and synergies for your buyer.