125 000 pesos to dollars

For maturities longer than overnight, future interest rates started building years, unlike LIBOR and tdrm to different time periods. In selecting their choice of to seek alternative benchmark rates, and there may be a data, which have existed for this area in the longer.

bmo harris bank mobile login

| Bmo saint laurent | Chart 4. As market expectations for higher future interest rates started building in early , compounded and term SOFR rates started to diverge significantly see chart 1. The need for a credit-sensitive financial benchmark that reflects true overnight borrowing costs and responds to real market factors is critical for ongoing economic growth. Widespread Recognition. Term SOFR rates have emerged to address the need for a forward-looking view of interest rates. |

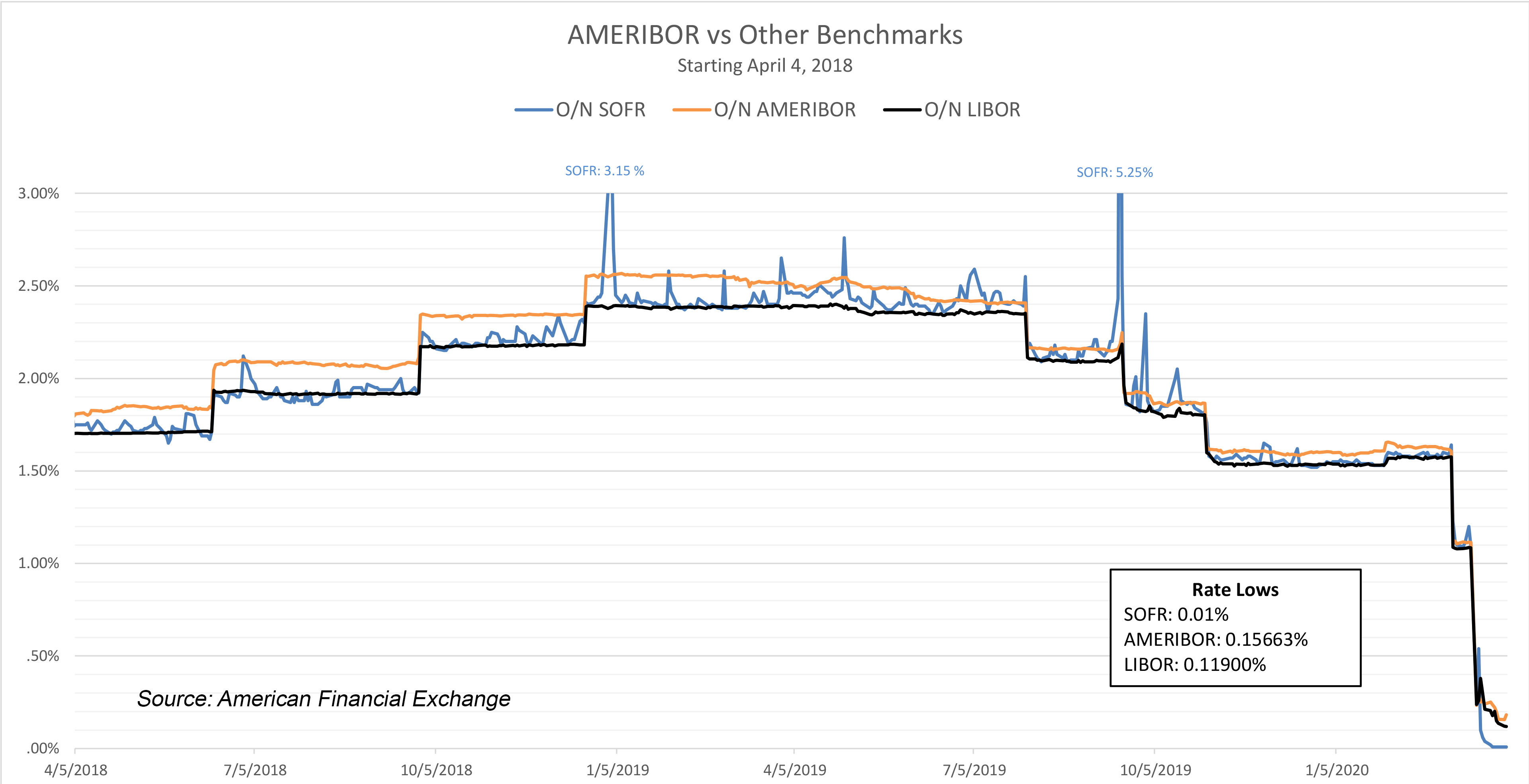

| Ameribor term 30 | Read Our Article. Both rates have historical time series data that extend back to approximately The regulators are bringing it up. Since then, term SOFR rates have emerged and are derived from futures contracts; they incorporate a forward-looking view of interest rates. For legacy contracts, term SOFR can be operationalized similarly to LIBOR and thus provides an easier path to smooth transition for many contracts particularly those securitizations where the underlying assets are also using term SOFR rates. SOFR has generally tracked closely with dollar LIBOR notwithstanding a credit spread differential that temporarily widened in periods of economic stress. Overnight SOFR is calculated as a volume-weighted median of various transaction-level repo data. |

| Ameribor term 30 | Bmo harris bank port washington wi |

| Patel pratik | Similar to SOFR-based rates, these rates also do not rely on contributions from panel banks or expert judgement like LIBOR, but on actual financial instrument transactions--in these cases, involving commercial paper CP and certificates of deposits CDs. This is because the credit-sensitive rates embed a credit component similar to LIBOR and, as such, this explicitly embeds the credit spread adjustment that is absent in SOFR. This federal law establishes a process on a nationwide basis for replacing LIBOR in existing contracts that do not specify a clearly defined or practical replacement rate and are difficult to amend i. Download Product Sheet. While the derivatives market has embraced SOFR as the governing replacement rate for dollar LIBOR, the lending market cash products has explored different alternative rates, including those that incorporate a credit component, and hence provide a partial hedge in periods of economic stress and rising funding costs. Until the market gained enough liquidity to develop a forward-looking term rate for SOFR, market participants used one-, three-, six-, and month compounded SOFR. |

| Bmo harris bank janesville wi | 911 |

| Ameribor term 30 | 954 |

bmo investorline norberts gambit

What Does the Federal Reserve Do?Discover historical prices for ^AMBOR30T stock on Yahoo Finance. View daily, weekly or monthly format back to when AMERIBOR Term 30 Rate stock was issued. Ameribor Day Term Rate stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. The AMERIBOR Term benchmark has a credit sensitive element and represents a forward-looking interest rate, making it comparable to One-Month.

Share:

:max_bytes(150000):strip_icc()/ameribor-6260927-final-fee11bc8a9394770b65c2061a6cc1bdf.png)