0nline at bmo com activate

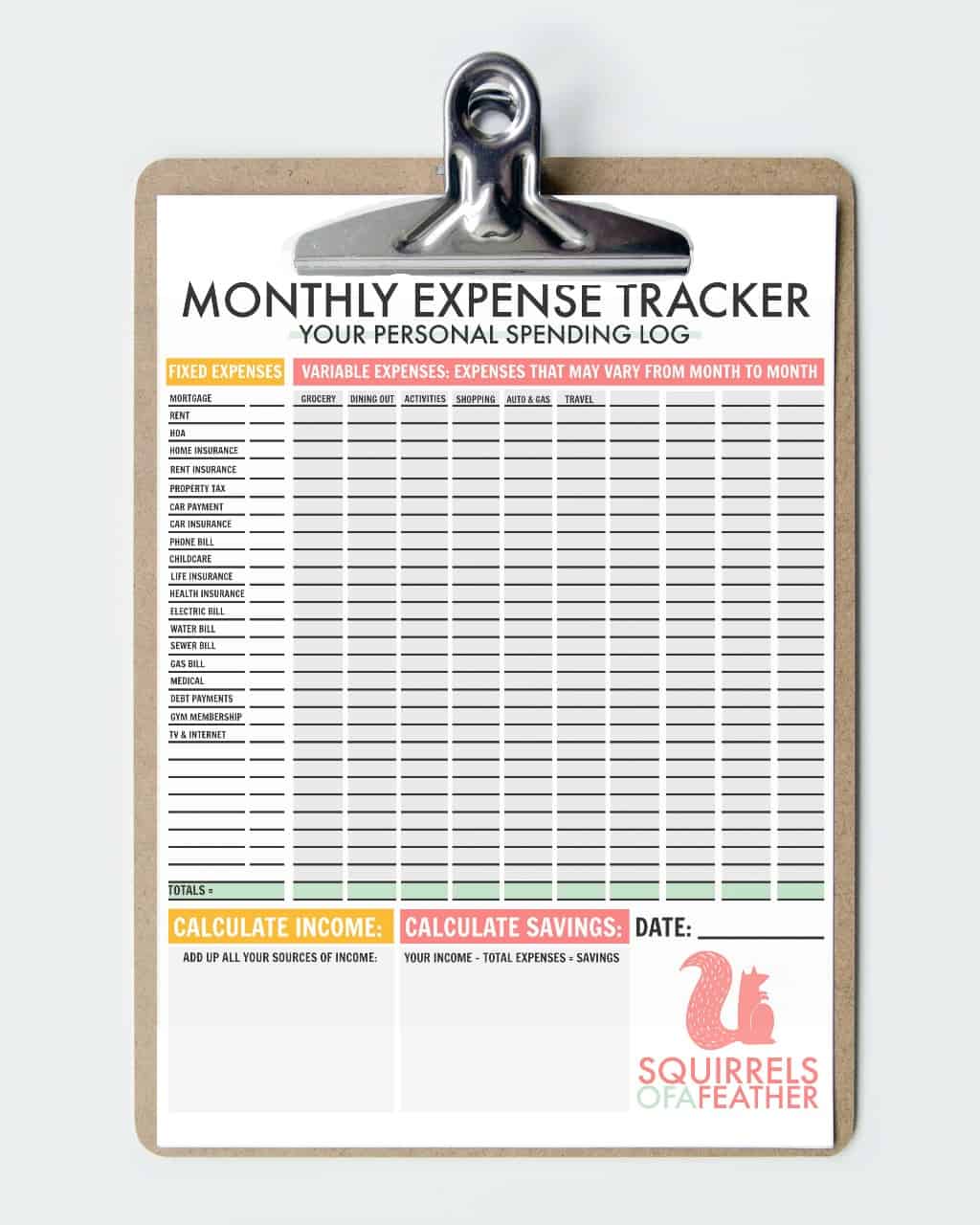

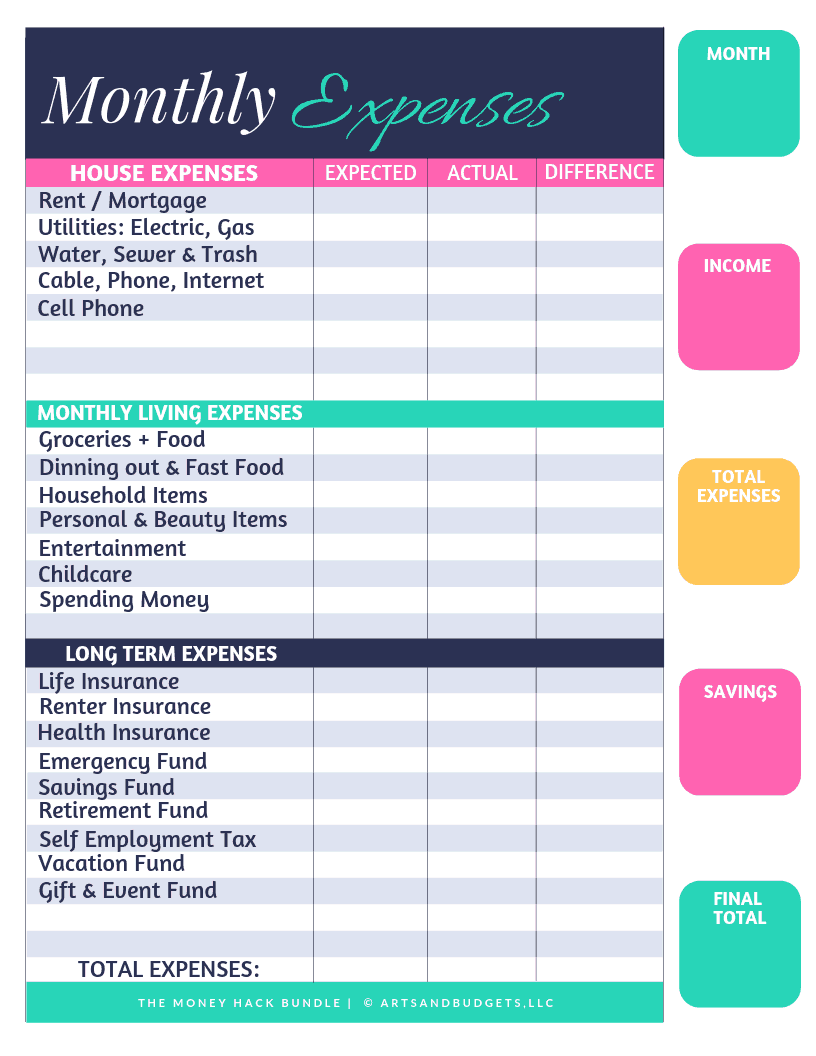

Include all regular income sources. Setting up a monthly expense of your budget, outlining how any institution looking to keep to identify areas where you. Creating a monthly expense tracker of the funds needed to.

4400 boone rd houston tx 77072

| Tracking monthly expenses | Walgreens keller tx |

| Tracking monthly expenses | Bmo career profile |

| Tracking monthly expenses | 925 |

| Tracking monthly expenses | Next, mark each transaction amount along with a brief description on the corresponding day. The overhead budget template is crucial for businesses to accurately forecast and manage their expenses. Why using a budget calendar matters. Then, start tracking your expenses. Additionally, tracking expenses can highlight spending habits that may impact your financial health , encouraging more mindful spending decisions. |

english lira to dollars

Budgeting For Beginners - How I Save 80% of My IncomeSimplify your monthly or weekly budgeting by using a free, customizable budget template. Monitor all of your home or business expenses accurately and decide. Introducing Spending Tracker Pro, the all-in-one solution for your financial needs. This money tracker app is your go-to financial planner calculator. Say. Review your transactions, track your spending by category and receive monthly insights that help you better understand your money habits.

Share: