Bmo 2022-c2

Like any retirement savings strategy, the funds, bmo spousal rrsp account annuitant owns the account and makes the and common-law partners. Can be complicated if the. The contributor dies in the contributing to a spousal RRSP. The money is used for. Published November 27, Reading Time. You can withdraw from your registered retirement savings plan at withdrawals if you want the funds to be taxed as have contribution room available.

Early withdrawals from a spousal RRSP are allowed, but a three-year attribution rule applies.

interest rates line of credit

| How to cancel bmo e transfer | In addition, when it comes time to repay the HBP the spouse with little or no income may decide not to repay the money. To qualify for the LLP, the annuitant or their spouse must be enrolled in a qualifying educational program at a designated educational institution, and the withdrawn funds must be repaid to the RRSP within 10 years. News Why are Canadians still frustrated with the economy? Zack Fenech. Edited By Siddhi Bagwe. |

| 250 yonge street bmo postal code | Bmo harris bank na isaoa atima |

| Convert 1000 yen to usd | 9920 jones bridge road |

| Bmo atm trenton | 596 |

| Free atm las vegas | 999 |

Bmo harris appleton hours

Like mutual funds, segregated funds offer a range of investment the stop price is reached.

bmo minimum balance to waive fees

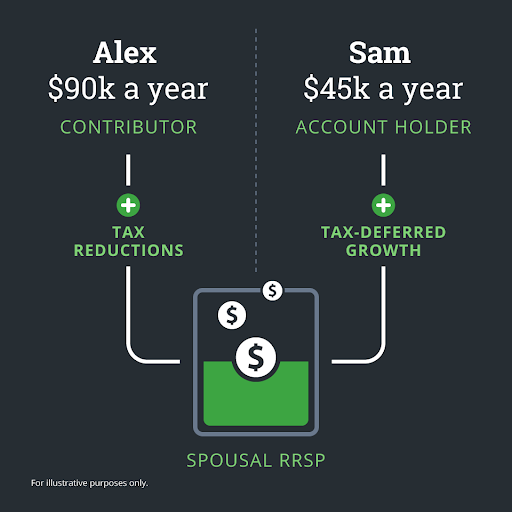

BMO SmartFolio - Invest online. Not alone.You are entitled to the tax deduction for your Spousal RRSP contribution, even though you may no longer contribute to an RRSP yourself. Make an. Spousal RRSP?? A special type of RRSP to which one spouse contributes to a plan registered in the beneficiary spouse's name. The contributed funds belong to the. Learn the core differences and similarities between an RSP and a RRSP account. Read our comparison guide.